Cryptocurrencies have evolved drastically since the advent of Bitcoin, giving rise to a diverse range of digital assets. Among these, Wrapped Bitcoin (WBTC) has emerged as a unique player that marries the value and recognition of Bitcoin with the flexibility of Ethereum. By bringing Bitcoin to the Ethereum network as an ERC-20 token, Wrapped Bitcoin has opened up new opportunities for Bitcoin holders within the burgeoning DeFi ecosystem. In this article, we present a detailed analysis of the current status and future outlook of Wrapped Bitcoin based on our recent findings.

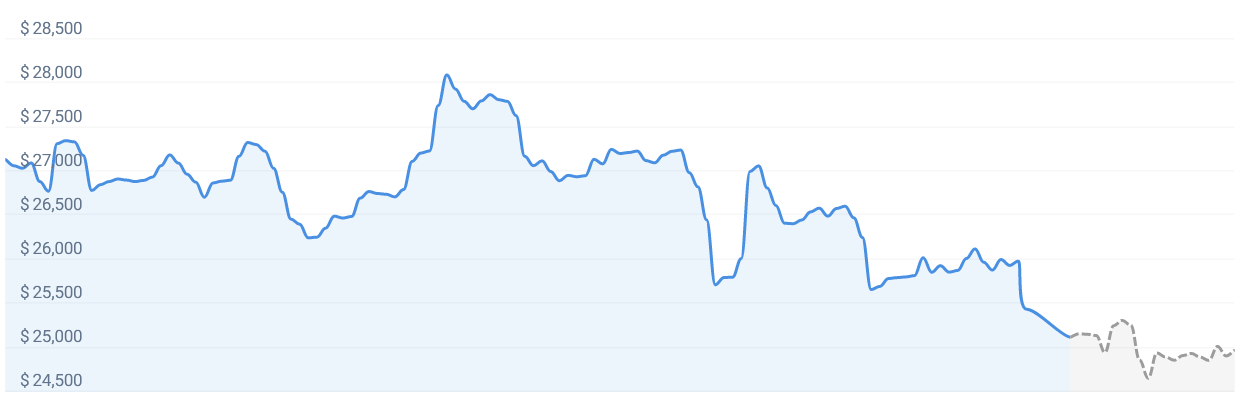

Our latest prediction forecasts a slight dip of around 0.43% in the value of Wrapped Bitcoin, suggesting that its value may fall to approximately $24,972 by June 20, 2023. It is essential to note, however, that the cryptocurrency market’s dynamic nature warrants a more comprehensive examination beyond these numbers alone.

Our technical indicators point to a current bearish sentiment in the market for Wrapped Bitcoin. The term ‘bearish’ refers to a market condition in which the prices of securities are falling, and widespread pessimism causes this negative sentiment to be self-sustaining. Given the current sentiment, traders and investors may expect a further downward trend for WBTC.

Complementing the sentiment analysis, the Fear & Greed Index currently stands at 41, indicating ‘Fear’ for Wrapped Bitcoin. The Fear & Greed Index is a valuable metric that offers insight into the market’s emotional and psychological state. In this context, a score of 41 suggests a sense of caution among market participants, potentially fueled by a fear of potential losses.

However, interpreting the market based solely on sentiment and fear and greed index can be misleading. Therefore, it’s also critical to evaluate the asset’s recent performance. Over the past month, Wrapped Bitcoin has seen 15 ‘green days,’ which are days when the asset’s price increased. This amounts to a positivity rate of 50% over the last 30 days.

Yet, it’s important not to overlook the inherent volatility of cryptocurrencies. Over the past month, Wrapped Bitcoin has experienced a price volatility of 2.03%. While volatility can present profitable trading opportunities, it also implies potential risks, particularly in a bearish market.

Taking into account the factors outlined above, our forecast suggests that now may not be an optimal time to purchase Wrapped Bitcoin. The current bearish sentiment, the fear indicated by the Fear & Greed Index, and the asset’s notable price volatility collectively point towards a high-risk environment.

Nonetheless, the unpredictable nature of the cryptocurrency market necessitates caution in interpreting these forecasts. It’s important to remember that no prediction or analysis can guarantee the future performance of any asset. Consequently, potential investors should stay updated with market news, monitor global economic events, and possibly seek advice from financial advisors before making investment decisions.

In conclusion, while our forecast predicts a marginal decrease in the value of Wrapped Bitcoin, with an estimated price of $24,972 by June 20, 2023, the current market indicators advocate caution. The Fear & Greed Index reflects a wary sentiment amongst market participants, hinting that it may not be an ideal time to invest in Wrapped Bitcoin. As always, potential investors should carefully evaluate their risk tolerance and stay informed about market movements before making any investment decisions.